Is Wall Street Bullish or Bearish on Norwegian Cruise Line Stock?

/Norwegian%20Cruise%20Line%20Holdings%20Ltd%20ship%20by-%20Tatiana%20Dyuvbanova%20via%20iStock.jpg)

With a market cap of $10.9 billion, Norwegian Cruise Line Holdings Ltd. (NCLH) is a leading global cruise company. It operates three distinct brands - Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises, offering diverse itineraries and premium onboard experiences worldwide.

Shares of the Miami, Florida-based company have outperformed the broader market over the past 52 weeks. NCLH stock has jumped 56.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18%. However, shares of Norwegian Cruise Line are down 2.9% on a YTD basis, lagging behind SPX’s 7.2% increase.

Focusing more closely, the cruise operator stock has also outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 24% return over the past 52 weeks.

Despite reporting weaker-than-expected Q2 2025 adjusted EPS of $0.51 and revenue of $2.5 billion, shares of NCLH climbed 9.2% on Jul. 31 due to a strong rebound in cruise demand and reaffirmation of its full-year EPS forecast of $2.05, slightly above the consensus. Occupancy reached 103.9% in Q2, up from 101.5% in Q1, and onboard spending remained strong, signaling consumer resilience despite earlier macroeconomic concerns.

For the fiscal year ending in December 2025, analysts expect NCLH’s EPS to grow 7.3% year-over-year to $1.76. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

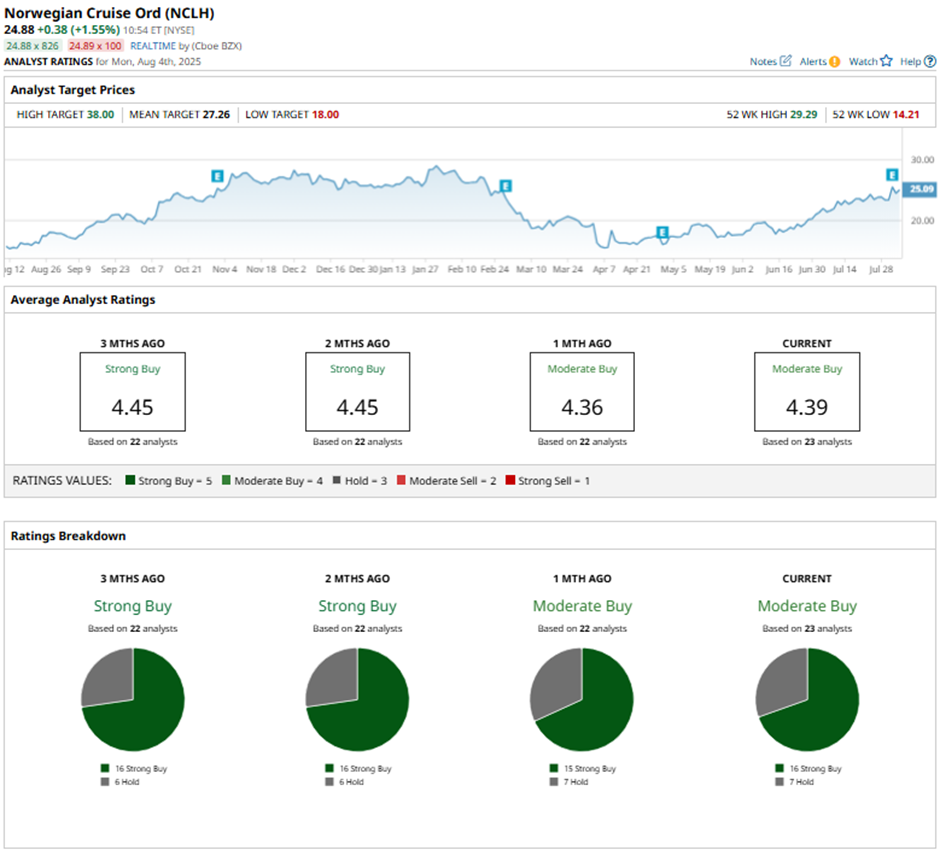

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings and seven “Holds.”

On Aug. 4, Morgan Stanley raised its price target on Norwegian Cruise Line to $26, maintaining an “Equal Weight" rating after the company’s Q2 beat and reflecting improved yield expectations from its private island investment.

As of writing, the stock is trading below the mean price target of $27.26. The Street-high price target of $38 implies a potential upside of 52.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.